SUSTAINABILITY

Riparian Capital Partners Pty Limited (‘RCP’) is committed to implementing, monitoring and reviewing Environmental, Social and Governance (ESG) practices across the business and across assets managed by the firm on an ongoing basis. Our ambition is to continuously enhance our understanding of sustainability and in doing so advance our ESG practices.

RCP is Certified BCorp, a signatory to the United Nations Principles of Responsible Investing (UNPRI) and the Paris Agreement on climate change. Consistent with UNPRI obligations, RCP incorporates ESG considerations in the investment process, policies and procedures. Additionally, RCP’s Sustainability Priorities have been informed by our commitments as a signatory of the UNPRI and are aligned with the UN Sustainable Development Goals.

RCP’s Philosophy

At RCP, our ability to successfully manage ESG factors is directly linked with our ability to sustainably deliver attractive returns to our investors. Our view is there is no bifurcation between investment returns and sustainability; indeed, as long-term investors in agriculture, we are incentivised to advance and enhance our ESG practices over time.

We view the analysis and management of ESG factors as an integral part of our business processes. We have publicly committed to implementing, monitoring and reviewing ESG practices across our business and the assets we manage.

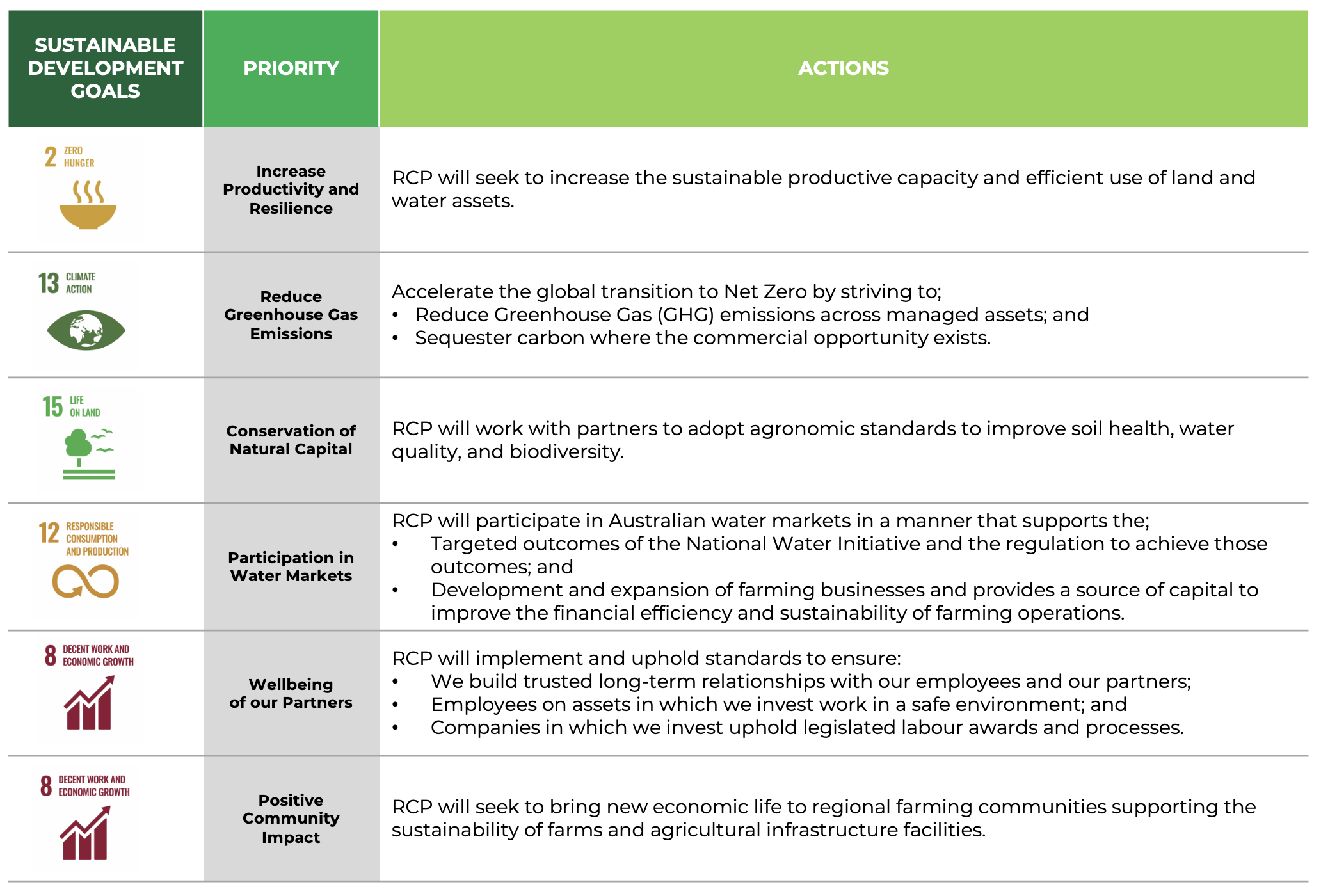

RCP’s Sustainability Priorities:

Riparian respects and acknowledges the Traditional Owners and Custodians of Country. We recognise their continuous connection to the lands, waters and skies across Australia and express our sincere gratitude to the peoples on whose land we work.

© Riparian Capital Partners Pty Ltd ACN 630 179 75. All rights reserved. Privacy Statement Disclaimer